In fact, there is no standard process or approach to an M&A deal, this article will only bring out the most general procedure, according to which an M&A transaction can be divided into three main stages as follows:

1. Preparation phase – Pre M&A:

Step 1. Search for a target company

Looking for a target company can be done via many channels such as the marketing of potential sellers, the network of the buyer, or through consulting units, brokerage organizations in the compatible business field, or specialized M&A consulting units;

At this step, the Buyer should make a preliminary assessment of the following factors, before deciding to proceed to the next step of the acquisition:

- Whether the target company’s operation field is consistent with the Buyer’s development orientation;

- Whether the Buyer can make use of the established base of customers, partners, or a certain market share of the target company in the market to serve the Buyer’s acquisition strategy;

- Whether the Buyer can take advantage of the technology investment, management experience, and skilled labor of the target company;

- Whether the target company has the advantage of available land, infrastructure, and facilities, which can be utilized to minimize initial investment costs.

Step 2. Due Diligence Report

Based on the preliminary assessment in Step 1, the Buyer will need a professional legal and financial consulting organization to evaluate the overall target company, before deciding on the acquisition.

Depending on the target company and the needs of the Buyer, the Buyer can organize an assessment of one or both types:

- Financial Due Diligence Report: for scrutinizing compliance with accounting standards, capital transfer, provisioning, loans from organizations and individuals, stability of cash flow (taking into account the business cycle), checking asset depreciation and debt recovery,…

- Legal Due Diligence Report: for assessing the whole and details of legal issues related to the entity legal status, capital contribution and status of shareholders, legal rights and obligations of the target company, property, labor, project…

The detailed due diligence report will help the Buyer understand the overall issues that need to be dealt with during the acquisition and company reorganization process.

2. Negotiation and transaction phase – M&A signing:

Negotiating and concluding M&A

Based on the results of the detailed due diligence, the Buyer can decide on a full or partial acquisition, as a basis for negotiating M&A content.

There are a few things to keep in mind at this stage, including:

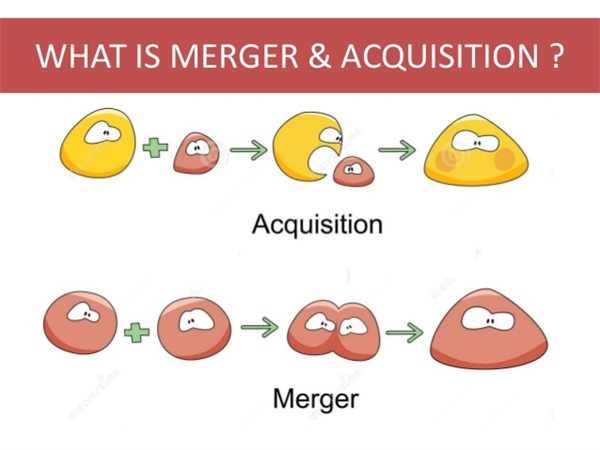

- The Buyer and the Seller need to understand the types and variations of M&A transactions to an appropriate and effective negotiation. In essence, with “Merger” (Buy), the acquired company ceases to exist, is completely acquired by the Seller; in return, with “Acquisition”, the two parties agree to merge into a new company instead of operating and owning separately. Regarding “acquisition” itself, there are many several variations such as horizontal mergers, market extension mergers, product extension mergers, conglomerate mergers, vertical mergers, etc…

- The M&A paradox frequently mentioned is when the Parties could not agree on the price of the transaction. To solve this problem, the parties to an M&A transaction tend to hire an independent appraiser to determine the value of the target company.

The outcome of this stage is a contract recording the form, price, and content of the M&A deal.

Legal procedures for concluding M&A

The acquisition of a business by the Buyer is only recognized by law when the legal procedures related to the recognition of the transfer from the Seller to the Buyer have been completed, especially with regard to the types of assets, rights, and liabilities register with the competent authority. Upon completion of this step, an M&A transaction can be considered closed and completed.

3. Enterprise restructuring phase – Post-M&A:

The challenges for the Buyer during this period are usually personnel uncertainties, immobility in management policies, conflicts in corporate culture, outstanding legal, and financial issues,…

Tiếng Việt

Tiếng Việt